Market Chameleon alerts and trading Ideas - Should you try?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Market Chameleon is a comprehensive options research platform with several pros and cons. Pros include a wide range of market research tools, comprehensive options research, and a 7-day free trial. Cons include a somewhat clunky interface, no mobile app, and a 15-minute market delay.

Market Chameleon is a popular options research platform that provides a wealth of tools and data to help investors and traders of all experience levels. As the options market continues to grow in popularity among both retail and professional traders, having a powerful yet user-friendly platform to leverage options research and analysis is increasingly important. This Market Chameleon review aims to provide readers with an overview of the platform's key features and benefits, as well as insights into pricing and whether it offers value for traders at different stages of their options trading journey. We will examine the platform's various stock screening, analytics and strategy tools, along with its watchlist creation capabilities and historical data offerings. The review also considers some potential drawbacks to consider.

What is Market Chameleon?

Market Chameleon is a platform specializing in options research for investors and traders. Established in 2007 by William McBride, it is based in Philadelphia, Pennsylvania. The platform's primary objective is to deliver valuable insights by providing unique tools and data that may be challenging to access for individual investors or smaller research firms. Its services concentrate on three key time horizons: Forward-Looking, Present, and Historical.

Catering to both novice and experienced options traders, Market Chameleon boasts a wide array of features and tools. Users can filter and search for options trading possibilities using stock screeners based on criteria like the underlying stock, expiration date, and option type. Furthermore, Market Chameleon presents an assortment of trading ideas, such as earnings alerts and options strategies, to assist traders in making informed choices.

In summary, Market Chameleon is a potent platform offering options research to help investors and traders thrive in the market. It is highly regarded for its accuracy and dependability in delivering options information. The platform's standing as a trusted source of options data has been sustained through its extensive experience in the industry.

Market Chameleon features review

Out of all the services Market Chameleon has to offer, the experts have reviewed some of the most unique and useful ones:

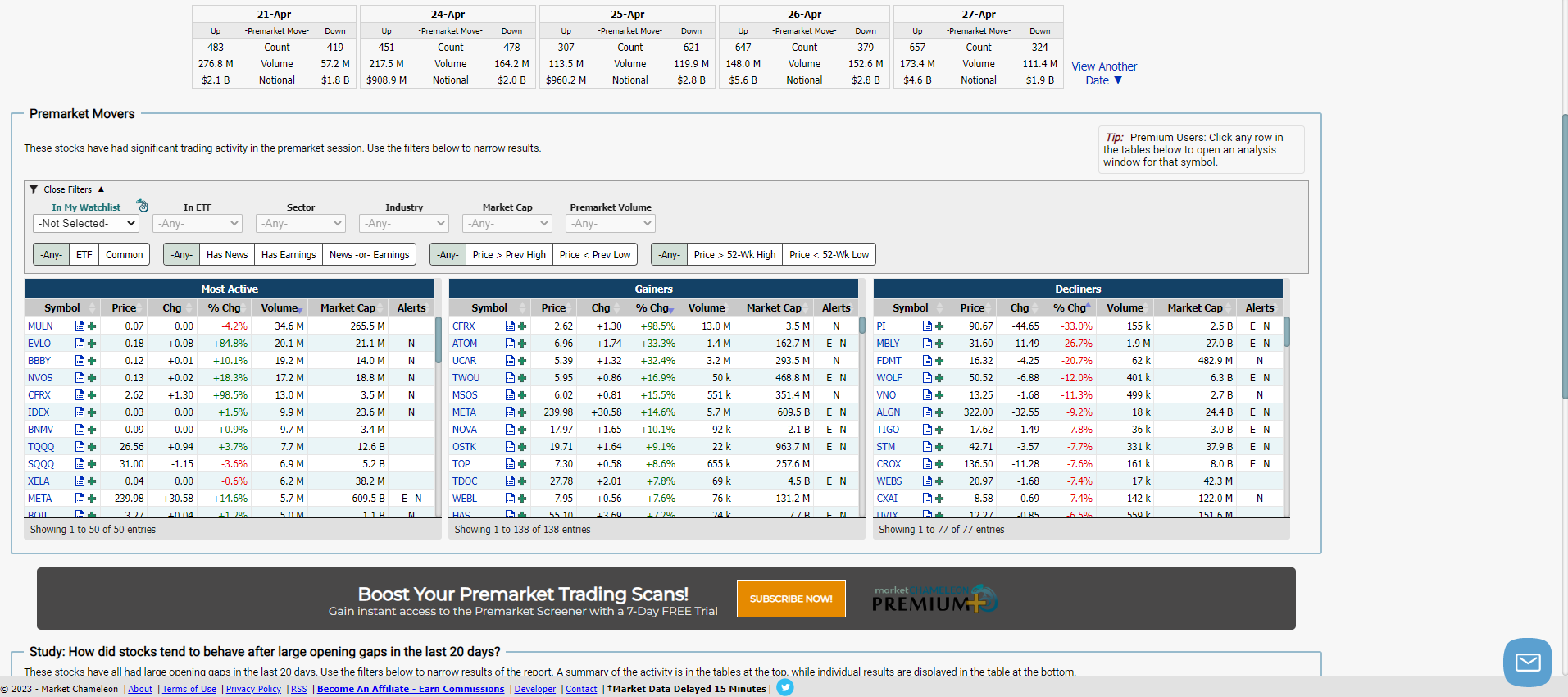

Unusual Options Volume Screen

Market Chameleon's Unusual Options Volume Screen is an invaluable tool for traders looking to uncover potential trading opportunities based on unusual options activity. This feature monitors and identifies instances where options trading volume significantly exceeds the average, indicating heightened interest in a particular stock or index. While it is important to approach these signals with caution, as they can sometimes be deceptive due to the growing popularity of options trading, this tool can offer valuable insights and help traders spot potential trends or upcoming events.

Volume screener

Volume screenerWatch Lists

The watch list feature on Market Chameleon enables users to create personalized and dynamic lists of stocks that they wish to monitor closely. By incorporating stocks from various screens, such as earnings lists, users can tailor their watch lists to meet their specific trading objectives. Additionally, the platform allows customization of alert triggers to notify users of significant price movements or other events, making it easier to stay informed and track potential opportunities as they arise.

Customizable watch lists

Customizable watch listsOptions Chains

Market Chameleon's Options Chains feature is designed to help users explore and analyze potential options trades with ease. The platform presents essential data points, such as Greeks, liquidity stats, and time and sales information, in a user-friendly and customizable layout. This comprehensive view of options data allows traders to make more informed decisions when considering various options strategies and positions.

Options chains building

Options chains buildingEarnings Calendar and Tools

Recognizing the importance of the earnings season for options trading, Market Chameleon provides a detailed earnings calendar and an array of tools designed to help traders capitalize on opportunities before, during, and after earnings reports. For example, the Stock Price Patterns Around Earnings feature showcases the price reactions of stocks leading up to and following earnings releases. This information can be invaluable for traders looking to gauge market sentiment and anticipate potential price movements surrounding earnings announcements.

Earnings calendar

Earnings calendarOptions Outcomes Around Earnings

This feature shows the performance of various options strategies during earnings reports, such as selling out-of-the-money (OTM) calls or OTM puts for a stock.

Options strategies

Options strategiesNews Feed

The platform features a news feed that aggregates headlines from various sources, allowing users to stay updated on relevant information about specific stocks.

News feed

News feedMarket Chameleon additional features

Apart from the features discussed above, Market Chameleon also offers the following:

Earnings Options Strategy Screener

Earnings Options Strategy Screener helps users identify trading opportunities during earnings season. Users can filter strategies such as Covered Calls, Naked Puts, Call Spreads, Put Spreads, and ATM Straddles.

Seasonality Screener

The Seasonality Screener in Market Chameleon helps users understand a stock's historical monthly performance. This feature allows investors to gain insights into potential seasonal trends and patterns in stock prices.

Event-Driven Historical Insights

The Event-Driven Historical Insights screener enables users to analyze stock reactions to significant market events, such as interest rate decisions and economic reports. This tool helps investors gain insights into potential market-moving events and make informed decisions.

Historical Price Return Distribution Report

This report allows users to evaluate the historical performance of a stock or index by examining its distribution of returns. It can help investors better understand a stock's risk and return profile.

Implied Volatility Movers by Options Expiration

This feature allows users to track daily changes in implied volatility for various options expiration dates. It helps investors identify potential opportunities and manage their risk exposure.

Options Order Flow Sentiment Tools

Market Chameleon's sentiment tools help users visualize the prevailing sentiment in options order flow. This can be useful for identifying stocks with strong bullish or bearish sentiment.

Open Interest Analysis Dashboard

The Open Interest Analysis Dashboard offers a quick view of open interest metrics, allowing users to monitor changes in the options market and identify potential trading opportunities.

Biotech Stock Catalyst Report for Options Traders

This specialized report focuses on biotech stocks and related events, offering insights and analysis for options traders interested in the healthcare sector.

Options Trader Tools

Over and above all the tools mentioned above, Market Chameleon also offers a suite of tools specifically designed for options traders, enabling in-depth analysis of options strategies and performance.

Stock and Options Screeners

Finally, the platform provides various stock and options screeners to help users identify potential trading opportunities based on multiple criteria, such as fundamental data, technical indicators, and price action.

Market Chameleon costs

| Service Level | Price |

|---|---|

| Starter | $0 |

| Stock Trader | $39/month |

| Options Trader | $69/month |

| Earnings Trader | $79/month |

| Total Access | $99/month |

Market Chameleon offers various pricing tiers to cater to different user needs. The Starter tier is free and includes features like intraday dividend announcements, stock tracking, and a newsletter.

For $39 per month, the Stock Trader tier provides access to all stock and options research tools, the dividend suite, and a newsletter. This plan suits new traders but has limited access to earnings and options research tools.

If you require a more comprehensive offering, consider the Options Trader or Earnings Trader plans, which cost $69 and $79 per month, respectively. These tiers grant access to a broader range of tools, including options research and earnings-based research tools.

For users seeking the most comprehensive experience, the Total Access plan costs $99 per month and provides access to the complete suite of products and tools, including all reports and screeners.

Is Market Chameleon worth it? Is it effective?

Market Chameleon is an online platform that provides investors with valuable insights and data to help them make informed decisions. It offers a range of tools, including options trading strategies, market analysis, and stock screening, among others.

The question of whether Market Chameleon is worth it and effective largely depends on the individual investor's needs and preferences. To help you dissect this further, experts have critically analyzed the platform from a user’s perspective.

One of the most significant advantages of Market Chameleon is the vast amount of data it provides. The platform offers real-time options trading data, historical stock prices, and extensive market analysis. This information can be invaluable for investors who rely on data to make informed decisions.

Market Chameleon also offers a range of options trading strategies, including a unique tool called the Max Pain Calculator. This tool helps investors to determine the maximum pain point for a particular stock or options contract. This information can be useful in developing trading strategies and making informed decisions.

Another feature that sets Market Chameleon apart is its stock screener. This tool allows investors to filter stocks based on various criteria, including earnings growth, market cap, dividend yield, and more. This feature can be helpful in identifying potential investments that fit an investor's specific criteria.

However, with all these advantages, there are also some downsides to Market Chameleon. One significant disadvantage is the cost. Market Chameleon charges a monthly subscription fee for access to its tools and data, which can be quite expensive for some investors.

Moreover, Market Chameleon's interface may be overwhelming for some investors, especially those who are new to trading. The platform offers an extensive range of tools, and it may take some time to navigate and understand how to use each one effectively.

Overall, Market Chameleon can be an effective tool for investors who are looking for comprehensive market data and options trading strategies. However, its high subscription fees and complex interface may not be suitable for all investors. So, it is essential to evaluate your investment needs and preferences before deciding whether Market Chameleon is worth the cost.

- Pros

- Cons

- In-depth options research: Market Chameleon delivers a wide variety of options research instruments tailored to options traders of all skill levels

- Diverse selection of market research tools: The platform offers a multitude of market research instruments catering to different investment approaches, encompassing fundamental analysis, technical analysis, and options analysis

- One-week free trial: Users can take advantage of a one-week free trial to test the platform and determine if it aligns with their investment requirements before opting for a paid subscription

- Option to create watchlists for various data points: Market Chameleon allows users to create personalized watchlists that can track a wide range of data points, such as stock prices, options volume, and unusual activity. This feature enables traders to monitor and manage their investments more efficiently, as they can quickly access relevant data and insights pertaining to their preferred stocks or options. The ability to create watchlists streamlines the research process and helps traders stay organized and informed about market developments that matter to them

- Historical performance data available: Market Chameleon provides users with access to extensive historical performance data for stocks and options, which is a valuable resource for traders conducting in-depth market analysis. By studying historical trends and patterns, traders can gain insights into how stocks or options have performed in the past under various market conditions, which may help inform their future investment decisions. This wealth of historical data enables traders to conduct comprehensive backtesting of their strategies and better understand the potential risks and rewards associated with their chosen investments

- Pricing tiers: Market Chameleon's selection of pricing tiers may not be suitable for all users. While a 7-day free trial is provided, users may still need to pay a fee to gain access to certain features and tools

- Clunky interface: Some users may find Market Chameleon's interface to be less intuitive and user-friendly compared to other platforms. The platform's layout and design may require some time to get accustomed to, which can be a disadvantage for those who prefer a smoother user experience

- No mobile app: Market Chameleon currently does not offer a dedicated mobile app, which can be a drawback for traders who rely on mobile devices for real-time market monitoring and trading. The absence of a mobile app may limit the platform's accessibility for those who prefer to manage their investments on-the-go

- 15-minute market delay: Market Chameleon's data has a 15-minute delay, which can be a disadvantage for traders who require real-time market data to make quick and informed decisions. This delay may be particularly concerning for day traders and those who engage in short-term trading strategies that depend on immediate market information

Is Market Chameleon safe?

According to our experts, Market Chameleon is a reputable and secure options research platform. The platform serves a diverse range of traders, from beginners embarking on their trading journey to experienced professionals seeking in-depth analysis and research.

One factor contributing to Market Chameleon's safety is its team of seasoned professionals who deliver expert insights and support. These industry specialists are committed to ensuring that traders obtain precise, current, and pertinent data to facilitate their decision-making. The platform's dedication to offering high-quality content from knowledgeable sources reinforces its standing as a safe and dependable options research platform.

Additionally, Market Chameleon places a significant emphasis on customer support, which can be vital for traders seeking help or clarification regarding the platform's various features and tools. The responsive support team is available to address questions and resolve any concerns that users might have, guaranteeing that traders feel secure and confident while utilizing the platform.

In conclusion, Market Chameleon is a safe and reliable options research platform providing a comprehensive array of tools and information to help traders make informed investment decisions. Its expert staff and devoted customer support contribute to a secure and dependable environment for traders at all experience levels.

How to start working with Market Chameleon

The experts have prepared the following step-by-step guide on how to start working with Market Chameleon:

Go to the Market Chameleon website

To start using Market Chameleon, visit their website at www.marketchameleon.com. From there, you can explore the platform's various features and subscription options.

Click on the "Free Trial" button to create an account

To access the features of Market Chameleon, you will need to create an account. Click on the "Free Trial" button, which can be found in the top-right corner of the homepage.

How to start working with Market Chameleon

How to start working with Market ChameleonChoose a pricing plan that fits your needs

Market Chameleon offers five different pricing plans, ranging from a free starter plan to a $99/month Total Access plan. Choose the plan that fits your trading needs and budget.

Select a price plan

Select a price planFill in your personal information and payment details to complete the subscription process

Once you have selected a pricing plan, you will be asked to provide your personal information and payment details to complete the subscription process. Market Chameleon accepts major credit cards, including Visa, Mastercard, and American Express.

Provide registration details

Provide registration detailsOnce your subscription is confirmed, log in to your account

After completing the subscription process, you will receive a confirmation email from Market Chameleon. Use the login credentials provided in the email to log in to your account.

Browse through the platform's features, such as stock market research, options volume and order flow data, stock and options screeners, and earnings

Once you have logged in to your account, explore the different features available on Market Chameleon. These features include stock market research, options volume and order flow data, stock and options screeners, earnings calendars and tools, and more.

Use the features to identify trading opportunities and generate trade ideas

Market Chameleon's features are designed to help you identify trading opportunities and generate trade ideas. Use the tools to analyze stock and options data and develop a trading strategy that aligns with your goals and risk tolerance.

Monitor your trades and adjust your strategies accordingly

Once you have initiated trades, it is important to monitor them regularly and adjust your strategies as needed. Market Chameleon provides real-time data and alerts to help you stay on top of market trends and make informed decisions.

Take advantage of the comprehensive tools and resources

Market Chameleon is a comprehensive platform that provides a wealth of tools and resources to help you make informed investment decisions. From stock market research to options strategies, there is something for everyone on this platform. Take advantage of the features to stay ahead of the curve and maximize your returns.

Is Market Chameleon the best stock screener for you?

Market Chameleon is a complete options research platform that equips traders and investors with a variety of features and tools to aid them in achieving success in the market. When determining if Market Chameleon is the ideal stock screener for your needs, consider the following points:

Tailored plans: Market Chameleon provides plans customized to match your experience level. There is a suitable plan for everyone, from beginners to advanced traders

Distinctive features: Market Chameleon delivers a diverse array of features and tools that most other options lack. This includes options volume and order flow data, an earnings calendar and tools, options research, stock research, and adjustable watchlists

Practical insights: Market Chameleon offers traders and investors practical insights to help them make well-informed decisions. The platform presents option analytics and stock fundamentals in user-friendly displays, incorporating both tabular and graphical views for quick, actionable trading insights

Budget-friendly solution: Market Chameleon presents a more affordable, user-friendly alternative with minimal market delay when compared to other data services that charge high fees for options information

Reputation: Market Chameleon has built a reputation as a reliable and trustworthy source of options data. Its long-standing presence in the market demonstrates the credibility and dependability of its services

FAQs

How much does Market Chameleon cost?

Pricing plans range from a free starter tier to $99/month for total access.

What trading tools does it provide?

It offers options chains, stock screeners, earnings calendars, option volume scans, customizable watchlists and more.

Does the platform integrate with brokers?

No, it does not directly integrate with brokers. You would need to execute trades through your own broker after identifying opportunities on Market Chameleon.

What trading strategies does it support?

It supports various options strategies like covered calls, earnings plays, spreads and more through its dedicated tools.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Backtesting is the process of testing a trading strategy on historical data. It allows you to evaluate the strategy's performance in the past and identify its potential risks and benefits.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

A day trader is an individual who engages in buying and selling financial assets within the same trading day, seeking to profit from short-term price movements.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.